The wine industry has a rich and storied history that spans thousands of years, evolving from ancient winemaking practices to the sophisticated global market we see today. Originating in regions like Mesopotamia and ancient Egypt, wine production has been an integral part of various cultures and economies. Over the centuries, advancements in viticulture and oenology have transformed wine from a local commodity to a multibillion-dollar global industry.

As of 2023, the global wine market is valued at approximately $340 billion, with expectations to grow steadily in the coming years. Factors contributing to this growth include increasing disposable incomes, expanding middle-class populations in emerging markets, and a rising appreciation for premium and fine wines. Additionally, innovations in winemaking technology and sustainable practices are attracting environmentally conscious consumers, further driving market expansion.

Importance of Investment Decisions

Why Consider the Wine Industry for Investment

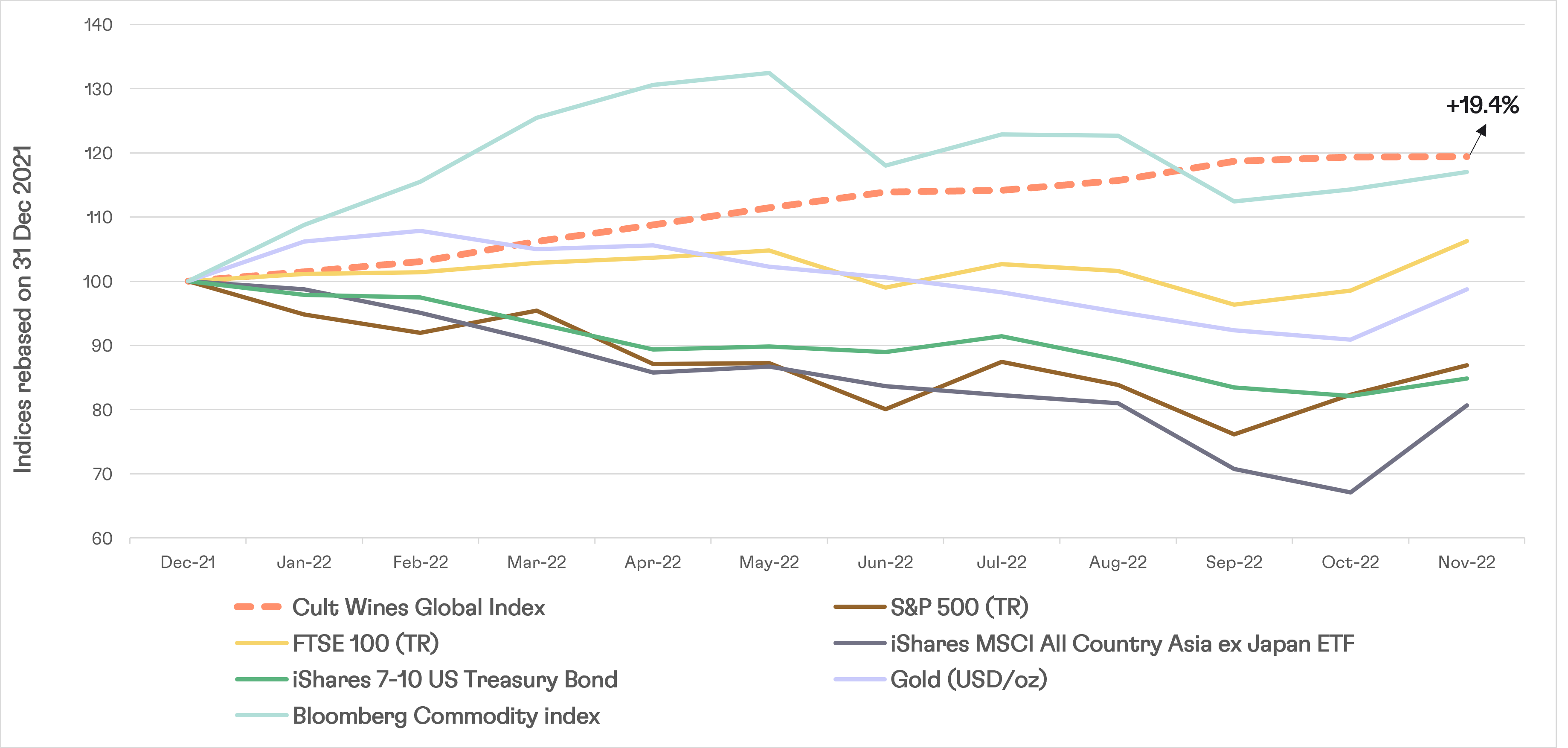

Investing in the wine industry presents a unique opportunity for diversification within an investment portfolio. Unlike traditional assets such as stocks and bonds, wine investments offer tangible assets that can appreciate in value over time. The wine market is influenced by a variety of factors, including climate conditions, consumer trends, and global economic shifts, providing investors with multiple avenues for potential returns.

Moreover, the fine wine segment has historically shown resilience and strong performance, often outperforming traditional investment vehicles during economic downturns. This makes the wine industry an attractive option for those seeking both growth and stability in their investment strategies.

The wine industry encompasses all activities related to the production, distribution, and sale of wine. This includes everything from grape cultivation and harvesting to winemaking, marketing, and retailing. The industry’s scope is vast, involving various stakeholders such as vineyard owners, winemakers, distributors, retailers, and consumers.

Key Components of the Wine Industry:

- Viticulture (Grape Growing):

- Climate and Terroir: The quality of wine is heavily influenced by the climate and terroir (the unique combination of soil, climate, and topography) of the vineyard.

- Grape Varieties: Different grape varieties, such as Cabernet Sauvignon, Chardonnay, and Pinot Noir, contribute to the diversity of wines available in the market.

- Winemaking (Oenology):

- Fermentation Processes: Techniques like malolactic fermentation and aging in oak barrels impact the flavor and quality of the wine.

- Quality Control: Ensuring consistency and quality through rigorous testing and adherence to winemaking standards.

- Distribution:

- Supply Chain Management: Efficient logistics are crucial for transporting wine from vineyards to distributors and retailers.

- Export and Import Regulations: Navigating international trade laws and tariffs to access global markets.

- Retail and Marketing:

- Wine Retailers: From local wine shops to large-scale distributors, retailers play a pivotal role in making wines accessible to consumers.

- Branding and Marketing: Effective branding strategies and marketing campaigns help wineries differentiate their products in a competitive market.

Key Players and Market Segments

Understanding the major players and market segments within the wine industry is crucial for evaluating investment opportunities.

Major Wine-Producing Countries:

- France:

- Renowned for regions like Bordeaux, Burgundy, and Champagne.

- Known for producing some of the world’s most prestigious and high-value wines.

- Italy:

- Famous for its diverse wine regions such as Tuscany, Piedmont, and Veneto.

- Produces a wide variety of wines, including Chianti, Barolo, and Prosecco.

- Spain:

- Key regions include Rioja, Ribera del Duero, and Catalonia.

- Known for both red and sparkling wines, particularly Tempranillo-based varieties.

- United States:

- Primarily concentrated in California’s Napa Valley and Sonoma County.

- Growing reputation for high-quality wines, especially Cabernet Sauvignon and Chardonnay.

- Australia:

- Notable regions include Barossa Valley, McLaren Vale, and Hunter Valley.

- Known for Shiraz and Chardonnay, among other varieties.

Leading Wineries and Brands:

- Château Margaux (France): One of the most prestigious wineries in Bordeaux, known for its exceptional Cabernet Sauvignon-based wines.

- Antinori (Italy): A historic family-owned winery with a significant presence in Tuscany and other regions.

- Penfolds (Australia): Renowned for its high-quality Shiraz and Cabernet Sauvignon blends.

Different Types of Wines and Their Markets:

- Fine Wines:

- High-quality wines with the potential for aging and value appreciation.

- Often produced in limited quantities, contributing to their exclusivity and investment appeal.

- Mass-Market Wines:

- Produced in larger volumes for widespread distribution.

- Typically more affordable and accessible to a broader consumer base.

- Organic and Sustainable Wines:

- Produced using environmentally friendly practices.

- Increasingly popular among eco-conscious consumers, offering a niche investment opportunity.

Current Trends in the Wine Industry

Staying abreast of the latest trends is vital for assessing the investment potential of the wine industry. Several key trends are currently shaping the market:

- Organic and Sustainable Wines:

- Rising Demand: Consumers are increasingly seeking wines produced with minimal environmental impact.

- Sustainable Practices: Wineries are adopting organic farming, biodynamic practices, and eco-friendly packaging to meet consumer expectations.

- Technological Advancements in Winemaking:

- Precision Viticulture: Utilizing data analytics, drones, and sensors to optimize grape growing and harvesting.

- Automation: Implementing automated systems in wineries to enhance efficiency and consistency in production.

- Changing Consumer Preferences:

- Health-Conscious Choices: Growing interest in low-alcohol and non-alcoholic wines as part of a healthier lifestyle.

- Premiumization: A shift towards premium and luxury wines, driven by consumers’ willingness to pay more for higher quality and unique experiences.

- E-commerce and Direct-to-Consumer Sales:

- Online Platforms: The rise of e-commerce has made wine more accessible, allowing consumers to purchase directly from wineries.

- Subscription Services: Wine clubs and subscription services offer curated selections, enhancing customer loyalty and steady revenue streams for wineries.

- Globalization and Emerging Markets:

- Expansion into New Regions: Countries like China, India, and Brazil are becoming significant markets for wine consumption.

- Cultural Shifts: As global cultures blend, there’s a growing appreciation for diverse wine styles and varietals.

- Sustainability and Climate Change:

- Impact on Viticulture: Climate change poses challenges such as altered growing seasons and increased incidence of pests and diseases.

- Adaptation Strategies: Wineries are investing in research and development to cultivate resilient grape varieties and implement sustainable practices.

Key Trends Impacting the Wine Industry

| Trend | Description | Impact on Investment |

|---|---|---|

| Organic and Sustainable Wines | Increased focus on environmentally friendly production methods | Opens niche investment opportunities with growing demand |

| Technological Advancements | Adoption of data analytics, automation, and precision viticulture | Enhances efficiency and potential for higher yields |

| Changing Consumer Preferences | Shift towards premiumization, health-conscious options, and unique experiences | Drives demand for high-quality and specialized wine products |

| E-commerce and Direct Sales | Growth of online sales platforms and subscription services | Expands market reach and provides new sales channels |

| Globalization and Emerging Markets | Expansion into countries like China, India, and Brazil | Increases market size and diversifies consumer base |

| Sustainability and Climate Change | Adapting to environmental challenges through innovative practices | Ensures long-term viability and resilience of wine investments |

Understanding these trends is crucial for investors looking to capitalize on the evolving dynamics of the wine industry. By aligning investment strategies with these trends, investors can better navigate the market and identify lucrative opportunities.

Investment Opportunities in the Wine Industry

When evaluating “Is the wine industry a good investment,” it’s essential to explore the various investment opportunities available within this multifaceted sector. The wine industry offers diverse avenues for investors, each with its unique benefits and considerations.

Investing in Wine Production Companies

Investing directly in wine production companies is one of the most straightforward ways to gain exposure to the wine industry. This approach involves purchasing shares of publicly traded wineries or private wine businesses.

Overview of Publicly Traded Wine Companies

Several wine companies are listed on major stock exchanges, allowing investors to buy shares and participate in their growth. Notable examples include:

- Constellation Brands (NYSE: STZ):

- One of the largest wine producers in the world.

- Diverse portfolio including brands like Robert Mondavi and Kim Crawford.

- Treasury Wine Estates (ASX: TWE):

- Australian-based company known for brands like Penfolds and Wolf Blass.

- Strong presence in both domestic and international markets.

- E. & J. Gallo Winery:

- Although privately held, it’s one of the largest family-owned wineries globally.

- Offers potential investment opportunities through private equity or partnerships.

Pros and Cons of Investing in Wine Corporations

Pros:

- Liquidity:

- Publicly traded wine companies offer high liquidity, allowing investors to buy and sell shares easily.

- Diversification:

- Investing in large wine corporations provides exposure to a broad range of products and markets.

- Potential for Growth:

- Companies expanding into emerging markets or innovating in sustainable practices may offer substantial growth prospects.

Cons:

- Market Volatility:

- Stock prices can be influenced by broader market trends and economic conditions, leading to volatility.

- Competition:

- The wine industry is highly competitive, with numerous players vying for market share, which can impact profitability.

- Dividend Dependence:

- Not all wine companies offer dividends, potentially limiting income for investors seeking regular payouts.

Buying and Selling Fine Wines

Another lucrative investment avenue is buying and selling fine wines. This strategy involves purchasing high-quality wines with the intention of holding them until their value appreciates, then selling them for a profit.

How to Purchase Fine Wines as an Investment

Investing in fine wines requires careful selection and understanding of the market. Here are key steps to get started:

- Research and Selection:

- Focus on renowned wine regions (e.g., Bordeaux, Burgundy, Napa Valley).

- Choose wines from prestigious vintages and reputable producers.

- Authentication:

- Ensure the provenance and authenticity of the wines to avoid counterfeit products.

- Purchase from reputable dealers or auction houses.

- Storage:

- Proper storage conditions are crucial to maintain wine quality and investment value.

- Consider professional wine storage facilities with controlled temperature and humidity.

Platforms and Marketplaces for Fine Wine Trading

Several platforms facilitate the buying and selling of fine wines, providing investors with access to a global marketplace:

- WineBid:

- An online auction platform offering a wide selection of fine wines.

- Provides detailed information and expert appraisals.

- Sotheby’s Wine Division:

- Renowned for high-end wine auctions and private sales.

- Access to rare and collectible wines.

- Vinovest:

- A digital investment platform specializing in fine wine.

- Offers portfolio management, storage solutions, and liquidity options.

Advantages of Fine Wine Investment

- Potential for High Returns:

- Fine wines can appreciate significantly over time, especially those from sought-after vintages and producers.

- Low Correlation with Traditional Assets:

- Wine investments often have a low correlation with stock and bond markets, providing diversification benefits.

- Tangible Asset:

- Unlike stocks or bonds, fine wines are physical assets that can be enjoyed or showcased.

Risks of Fine Wine Investment

- Market Liquidity:

- Selling fine wines can be time-consuming, and finding the right buyer may take longer compared to liquid assets.

- Storage and Insurance Costs:

- Proper storage is essential to preserve wine quality, incurring additional costs.

- Insurance is necessary to protect against theft, damage, or loss.

- Valuation Challenges:

- Accurately valuing fine wines can be complex, requiring expertise and market knowledge.

Wine Funds and Investment Vehicles

For investors seeking a more hands-off approach, wine funds and investment vehicles offer a structured way to invest in the wine industry.

What are Wine Investment Funds?

Wine investment funds pool capital from multiple investors to create a diversified portfolio of fine wines. These funds are managed by professionals who handle the selection, acquisition, storage, and eventual sale of the wines.

How to Invest in Wine Funds

- Research Fund Managers:

- Look for reputable firms with a proven track record in wine investments.

- Evaluate their investment strategies and performance history.

- Understand the Fee Structure:

- Be aware of management fees, performance fees, and any other associated costs.

- Assess Minimum Investment Requirements:

- Wine funds often have minimum investment thresholds, which can vary significantly.

- Review Fund Terms:

- Understand the fund’s investment horizon, liquidity options, and exit strategies.

Benefits and Risks of Wine Funds

Benefits:

- Professional Management:

- Expert fund managers with industry knowledge handle investment decisions and portfolio management.

- Diversification:

- Access to a wide range of wines, reducing the risk associated with individual wine investments.

- Convenience:

- Investors do not need to manage the day-to-day aspects of wine storage and sales.

Risks:

- Fees:

- Management and performance fees can impact overall returns.

- Market Dependence:

- Returns are subject to the performance of the fine wine market, which can be influenced by various external factors.

- Liquidity Constraints:

- Some wine funds have lock-in periods, limiting the ability to withdraw investments quickly.

Wine Futures (En Primeur)

Wine futures, also known as En Primeur, represent a unique investment opportunity within the wine industry. This method involves purchasing wines before they are bottled and released to the market.

Explanation of Wine Futures

Wine futures allow investors to buy wine while it is still in the barrel, often at a lower price than the wine’s expected market value upon release. This practice is prevalent in regions like Bordeaux, where wines are typically released a few years after the harvest.

How to Participate in Wine Futures

- Choose a Reputable Producer:

- Select wineries with a strong track record and positive reviews from critics.

- Understand the Terms:

- Review the contract details, including pricing, delivery timelines, and storage conditions.

- Place an Order:

- Commit to purchasing a certain quantity of wine futures, often requiring a deposit or full payment upfront.

- Monitor Production and Release:

- Stay informed about the wine’s production progress and anticipated release dates.

Potential Returns and Risks

Potential Returns:

- Price Appreciation:

- If the wine gains acclaim and demand increases, the value of the futures can rise significantly upon release.

- Access to Limited Releases:

- Investing in exclusive or limited-production wines can lead to substantial returns if the wines become highly sought after.

Risks:

- Quality Uncertainty:

- The final quality of the wine is not guaranteed until it is bottled and reviewed by critics.

- Market Fluctuations:

- Changes in consumer preferences or economic conditions can impact the demand and price of the wine upon release.

- Liquidity Issues:

- Selling wine futures before the wine is released can be challenging, potentially limiting exit options.

Comparison of Investment Opportunities

To help you decide which wine investment opportunity aligns best with your financial goals and risk tolerance, here’s a comparison of the key options:

| Investment Type | Pros | Cons |

|---|---|---|

| Wine Production Companies | High liquidity, potential for growth, diversification | Market volatility, competition, possible lack of dividends |

| Buying and Selling Fine Wines | Potential for high returns, tangible asset, low correlation with traditional assets | Market liquidity, storage and insurance costs, valuation challenges |

| Wine Funds and Investment Vehicles | Professional management, diversification, convenience | Fees, market dependence, liquidity constraints |

| Wine Futures (En Primeur) | Price appreciation, access to limited releases | Quality uncertainty, market fluctuations, liquidity issues |

Case Study: Successful Wine Investment

Case Study: Château Lafite Rothschild

Château Lafite Rothschild, one of Bordeaux’s most prestigious wineries, offers an exemplary case of successful wine investment. Over the past two decades, investment in Château Lafite Rothschild wines has yielded substantial returns due to the winery’s consistent quality, limited production, and strong global reputation.

- Initial Investment:

- Purchasing a bottle of Château Lafite Rothschild from a renowned vintage (e.g., 2000) at approximately $500.

- Current Value:

- The same bottle, now aged to perfection, can fetch upwards of $2,500 in the secondary market.

- Return on Investment:

- A 400% increase in value over 24 years, showcasing the potential for significant appreciation in fine wine investments.

This case highlights the importance of selecting wines from reputable producers and sought-after vintages to maximize investment returns.

Pros of Investing in the Wine Industry

When considering “Is the wine industry a good investment,” it’s crucial to evaluate the advantages that this sector offers. Investing in the wine industry can provide several benefits that make it an attractive option for diverse investors.

Potential for High Returns

One of the most compelling reasons to consider investing in the wine industry is the potential for high returns. Fine wines, especially those from prestigious regions and renowned vintages, have historically appreciated significantly over time.

- Historical Performance:

- Over the past few decades, fine wines have shown impressive returns. For example, wines from Bordeaux and Burgundy have consistently increased in value, often outperforming traditional investment assets like stocks and bonds.

- According to the Liv-ex Fine Wine 100 Index, fine wine has delivered an average annual return of approximately 8-10% over the last 20 years, outpacing many other alternative investments.

- Scarcity and Demand:

- Limited production and increasing global demand contribute to the appreciation of fine wines. As vintages age, their scarcity grows, driving up prices among collectors and investors.

- Wines from exceptional vintages, such as Bordeaux 2000 or Burgundy 2010, have seen substantial price increases due to their limited availability and high demand.

- Appreciation Factors:

- Provenance: Wines with documented histories and from reputable producers tend to hold and increase their value better.

- Storage Conditions: Properly stored wines maintain their quality, ensuring they remain desirable and valuable over time.

- Critical Acclaim: High scores and reviews from wine critics can significantly boost a wine’s market value.

Tangible Asset

Investing in the wine industry provides a tangible asset, offering several unique advantages compared to intangible investments like stocks or bonds.

- Physical Ownership:

- Unlike digital assets, owning physical wine allows investors to enjoy their investment. Wines can be consumed, gifted, or showcased, providing both financial and personal satisfaction.

- Intrinsic Value:

- Fine wines possess intrinsic value based on their quality, taste, and rarity. This intrinsic value can be more stable compared to some financial assets, which are subject to market volatility.

- Durability:

- Properly stored wines can age gracefully for decades, often increasing in value as they mature. This durability makes wine a long-term investment asset that can withstand economic fluctuations.

- Aesthetic and Cultural Appeal:

- Wine has a rich cultural heritage and aesthetic appeal, adding a layer of enjoyment and prestige to the investment. Owning rare wines can also enhance an investor’s social status and connections within the wine community.

Diversification of Investment Portfolio

Diversifying your investment portfolio is a fundamental strategy to mitigate risk and enhance potential returns. The wine industry offers excellent diversification benefits.

- Low Correlation with Traditional Assets:

- Fine wine investments typically exhibit a low correlation with traditional financial markets such as stocks and bonds. This means that wine prices are influenced by different factors, reducing overall portfolio risk.

- Hedge Against Inflation:

- Tangible assets like fine wine can act as a hedge against inflation. As the cost of living increases, the value of collectible wines often rises, preserving the investor’s purchasing power.

- Variety of Investment Options:

- The wine industry offers various investment avenues, including direct purchase of fine wines, wine funds, and investment in wine-producing companies. This variety allows investors to tailor their investments to their risk tolerance and financial goals.

- Global Market Exposure:

- Investing in fine wines provides exposure to global markets, as the demand and appreciation of wines are influenced by international trends and economic conditions. This global exposure adds another layer of diversification to your portfolio.

Growing Global Demand

The global demand for wine continues to grow, driven by several factors that enhance the investment potential of the wine industry.

- Expanding Middle Class:

- Emerging economies, particularly in Asia and Latin America, are experiencing a rise in the middle-class population with increased disposable incomes. This demographic shift leads to higher consumption of luxury goods, including fine wines.

- Cultural Shifts and Appreciation:

- As global cultures blend, there is a growing appreciation for diverse wine styles and varietals. This increased cultural appreciation broadens the market for various types of wines, enhancing their investment appeal.

- Premiumization Trend:

- Consumers are increasingly seeking premium and high-quality wines, willing to pay more for superior taste and exclusivity. This trend supports the appreciation of fine wines and creates lucrative investment opportunities.

- E-commerce and Accessibility:

- The rise of e-commerce platforms has made fine wines more accessible to a global audience. Online sales channels expand the market reach, driving up demand and supporting higher investment returns.

- Health and Lifestyle Trends:

- Moderate wine consumption is often associated with health benefits, contributing to its popularity. Health-conscious consumers are turning to quality wines as part of a balanced lifestyle, further boosting demand.

Advantages of Investing in the Wine Industry

| Advantage | Description |

|---|---|

| Potential for High Returns | Fine wines have historically outperformed traditional investments with significant appreciation rates. |

| Tangible Asset | Physical ownership of wine provides intrinsic value and personal enjoyment. |

| Diversification | Low correlation with traditional assets reduces overall portfolio risk. |

| Growing Global Demand | Expanding markets and increasing appreciation for fine wines drive sustained demand and value growth. |

| Hedge Against Inflation | Wine investments can preserve purchasing power as their value rises with inflation. |

| Aesthetic Appeal | Ownership of fine wines adds cultural and aesthetic value to the investment portfolio. |

Case Study: The Rise of Napa Valley Wines

Napa Valley, renowned for its premium Cabernet Sauvignon and Chardonnay, serves as an excellent example of the investment potential within the wine industry.

- Initial Investment Surge:

- In the 1990s, Napa Valley wines began gaining international acclaim, leading to a surge in demand and prices. Early investors in Napa Valley wines saw substantial returns as the region established itself as a premier wine-producing area.

- Market Appreciation:

- A bottle of Napa Valley Cabernet Sauvignon from a reputable producer like Opus One or Screaming Eagle can appreciate several times its original price over a decade. For instance, a bottle purchased at $300 in 2005 might be valued at $1,200 or more today.

- Global Recognition:

- Napa Valley’s reputation on the global stage has attracted international investors and collectors, further driving up demand and prices. The region’s commitment to quality and innovation has ensured its wines remain highly sought after.

- Sustainable Practices:

- Many Napa Valley wineries have adopted sustainable and organic farming practices, aligning with global trends towards eco-friendly products. This commitment enhances the appeal and value of their wines among environmentally conscious investors.

Impact on Investment:

The success of Napa Valley wines highlights how investing in well-established and high-quality wine regions can yield significant returns. The combination of global recognition, consistent quality, and limited production creates a robust investment environment that benefits both individual collectors and institutional investors.